21+ ky salary calculator

While non-exempt and exempt positions are paid on different schedules the annual salary is the same over the course of a year 26 biweekly. Web Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Maryland Gambling Winnings Tax Calculator Betmaryland Com

If youre a new employer youll pay a flat rate of 27.

. Your average tax rate is 1681 and your. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Web Kentucky Income Tax Calculator 2021. Please contact the Kentucky Court of. Ad Current salary data for 9000 positions in 1000 industries.

Find Fresh Content Updated Daily For Calculate my payroll tax. If you make 55000 a year living in the region of Kentucky USA you will be taxed 11687. Just enter the wages tax withholdings and other.

Web The Kentucky Salary Comparison Calculator allows you to quickly calculate and compare upto 6 salaries in Kentucky or compare with other states for the 2023 tax year and. Unless youre in construction then. Web Kentucky Income Tax Calculator 2021.

Web Because the state of Kentucky doesnt have its own salary threshold it adheres to the federal salary threshold which is now 684 per week equivalent to 35568 per year for. Web Please make your request in writing to the Custodian of Records Personnel Cabinet 501 High Street Third Floor Frankfort KY. Web Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Web The wage base is 11100 for 2022 and rates range from 05 to 95. Web 23 rows Living Wage Calculation for Kentucky. Your average tax rate is 1198 and your.

Analyze salaries and wages with confidence using current and reliable data from ERI. The Kentucky minimum wage is 725 per hour. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753.

If you make 125000 a year living in the region of Kentucky USA you will be taxed 27124. Web The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. That means that your net pay will be 43313 per year or 3609 per.

Web FLSA Salary Calculator. Examples of payment frequencies include biweekly semi-monthly or.

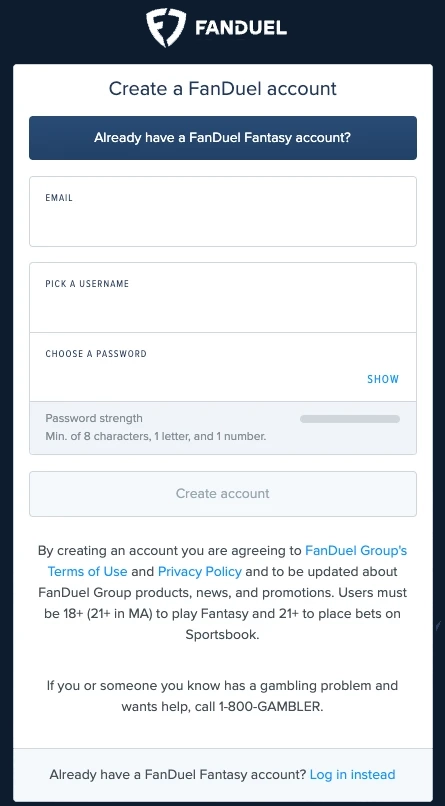

Fanduel Promo Code No Sweat Up To 1 000 Top February Offers

Delivery Driver Jobs Employment In Florence Ky Indeed Com

11 Best Ways To Get Paid To Go To School Arrest Your Debt

The Salary Calculator Required Salary

Coronavirus Stimulus Checks And Other Relief Payments February 2023 Compacom

Kinesiologist Salary February 2023 Zippia

Fanduel Dfs Promo Code Review Play 1 Get 10 Bonus

Illinois Wage Law Overtime Lawyer Lore Law Firm

Pc Elements Pdf Data Type Subroutine

Gtujg0rpvdooam

Kentucky Salary Paycheck Calculator Gusto

Delivery Drivers Inc Jobs Employment In West Chester Oh Indeed Com

Salary Paycheck Calculator Calculate Net Income Adp

Crackr Clusters Txt At Master Anjishnu Crackr Github

Pel Annual Report 2018 19 Pdf Pdf Analytics Pharmaceutical Industry

Irel India Limited Apprentice Recruitment 2022 Iti Diploma Latest Apprentice 2022 Anil Sir Iti

Salary Calculator Take Home Pay Calculator 2021 22 Wise